indiana excise tax alcohol

State Excise police officers are empowered by statute to enforce the laws and. In addition to or instead of traditional sales taxes cigarettes and other tobacco products are subject to excise taxes on both the Indiana and Federal levels.

School for the Deaf Indiana.

. 3 rows Indiana Liquor Tax - 268 gallon. Like many excise taxes the treatment of spirits varies. There are three options for electronically filing.

Have a State Excise Officer speak at my school or organization. For taxable years beginning before January 1 2021 the tax is imposed at a rate of 14 on gross receipts from all utility services consumed within Indiana. For more information on the food and beverage tax you may call our business tax information line at.

You may also contact your county auditors office to learn if your county has this tax. Attend a certified server training program in my area. LIQUOR EXCISE TAX IC 71-4-3 Chapter 3.

Alcoholic Beverage Wholesalers Excise Tax Return. Gallons Received During Reporting Month from. House Bill 1604 would raise the excise tax on liquor beer and wine sales by 100.

Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1. Purchasers of spirits in Indiana have to pay a state excise tax of 268 per gallon. The Alcohol and Tobacco Commission ATC is happy to provide guidance and direction on the process for submitting applications and obtaining.

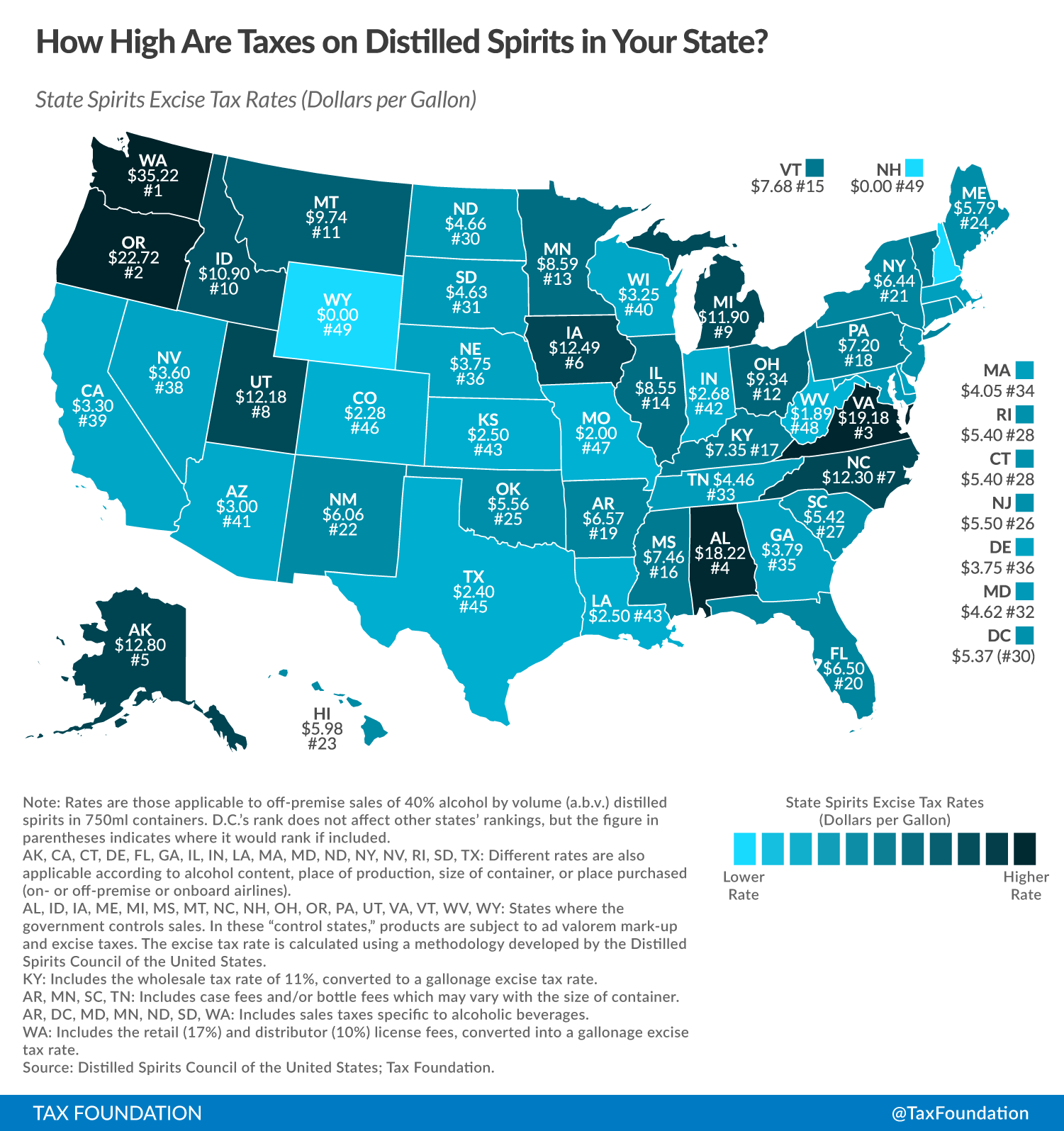

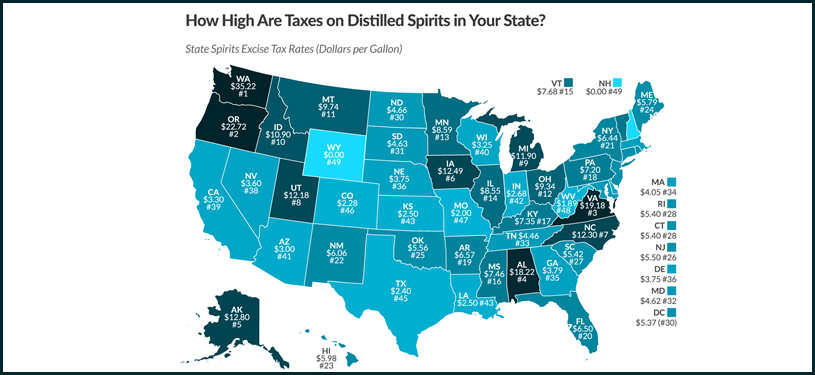

Supporting schedule to be filed with ALC-W. This 42 million tax hike alone would cause the price of distilled spirits to rise by 7 and would. Missouri taxes are the next lightest at 200 a gallon followed by Colorado 228 Texas 240 and Kansas 250.

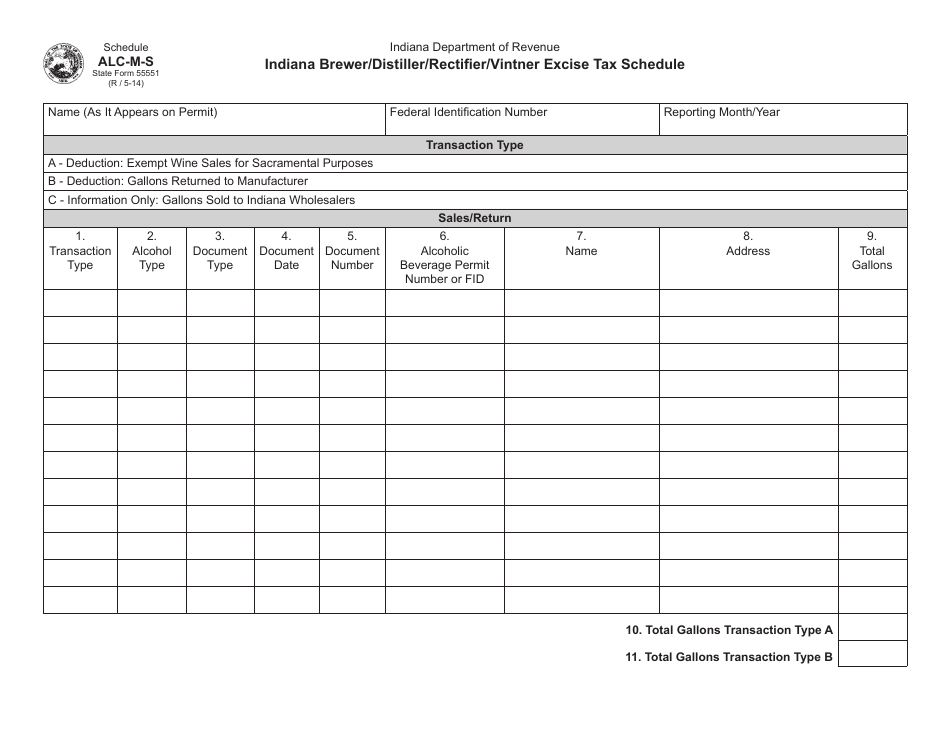

Please visit the Electronic Filing for Alcohol Taxpayers webpage for electronic filing information. State Form Number. All forms must be filed electronically.

For beer they pay an extra 11 and one-half cents. Consumers pay 268 per gallon 637 per 9 L cs and 053 per 750ml bottle. As of January 1 2020 the current federal alcohol excise tax rates are.

Ethics Commission Indiana State. Gasoline Use Tax - GUT. Purchasers of spirits in Indiana have to pay a state excise tax of 268 per gallon.

The Indiana State Excise Police is the law enforcement division of the Alcohol Tobacco Commission. Can you buy alcohol in Indiana on. Special Fuel - SFT.

Alcohol Type Indicate the alcohol type being. Alcohol Taxes in Indiana. Although electronic filing is required paper forms with instructions are available so customers can visualize what is required.

Auditor of State. Bond Bank Indiana. Motor Fuel - MFT.

Excise taxes on tobacco are. And for wine the pay an extra 47 cents. Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1.

Not part of tax calculation. A tax rate of 1334 per proof. Taxes Finance.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services. A tax rate of 270 per proof gallon on the first 100000 proof gallons in production. Supporting Schedule to be filed with Monthly Excise Tax Return ALC-DWS-S Indiana Sales Use Tax ST-103 Instructions form mailed to taxpayer.

Transaction Type Indicate the transaction type being reported A B or C. Indianas general sales tax of 7 also applies to the. Indiana Alcoholic Beverage Permit Numbers Section B.

Alcohol. Indiana has a state excise tax. The price of all motor fuel sold in Indiana also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway.

The paper forms with instructions shown below are available so customers can visualize what is required. Apply for employment as an Indiana State Excise Police officer. Alcohol Beverage Applications Forms.

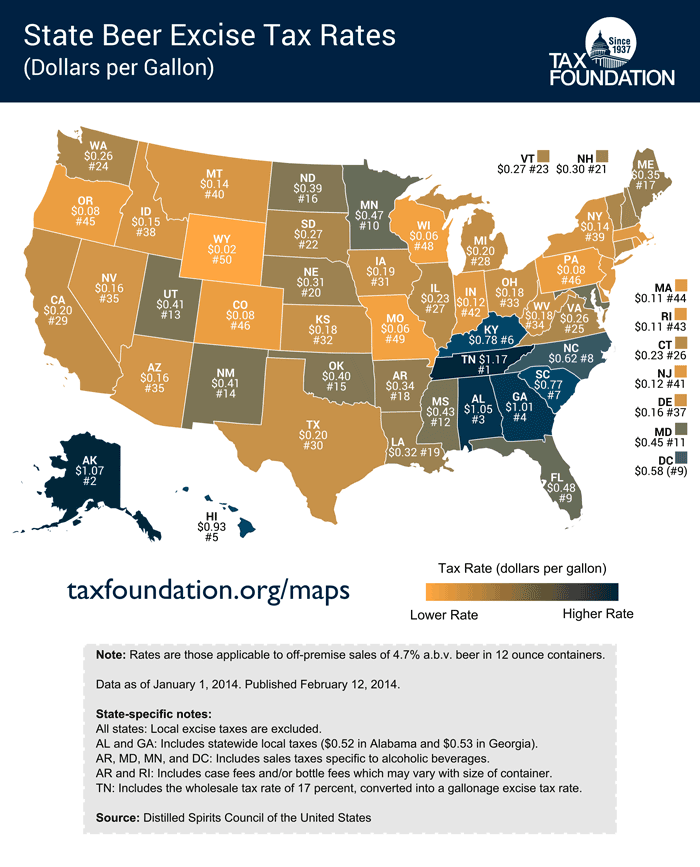

These States Have The Highest And Lowest Alcohol Taxes

Form Alc M State Form 55551 Schedule Alc M S Download Fillable Pdf Or Fill Online Indiana Brewer Distiller Rectifier Vintner Excise Tax Schedule Indiana Templateroller

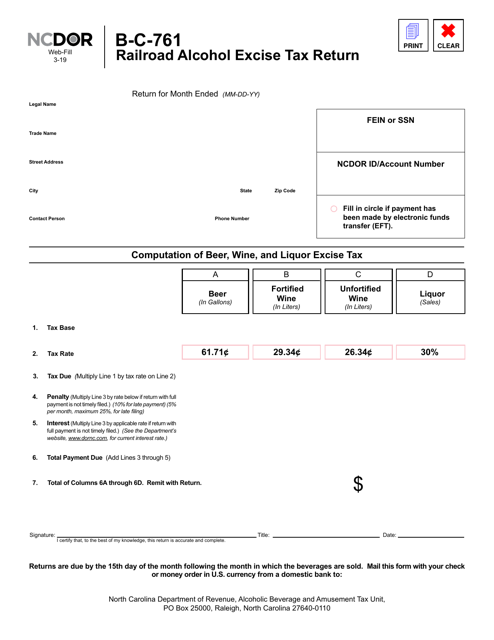

Form B C 761 Download Fillable Pdf Or Fill Online Railroad Alcohol Excise Tax Return North Carolina Templateroller

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

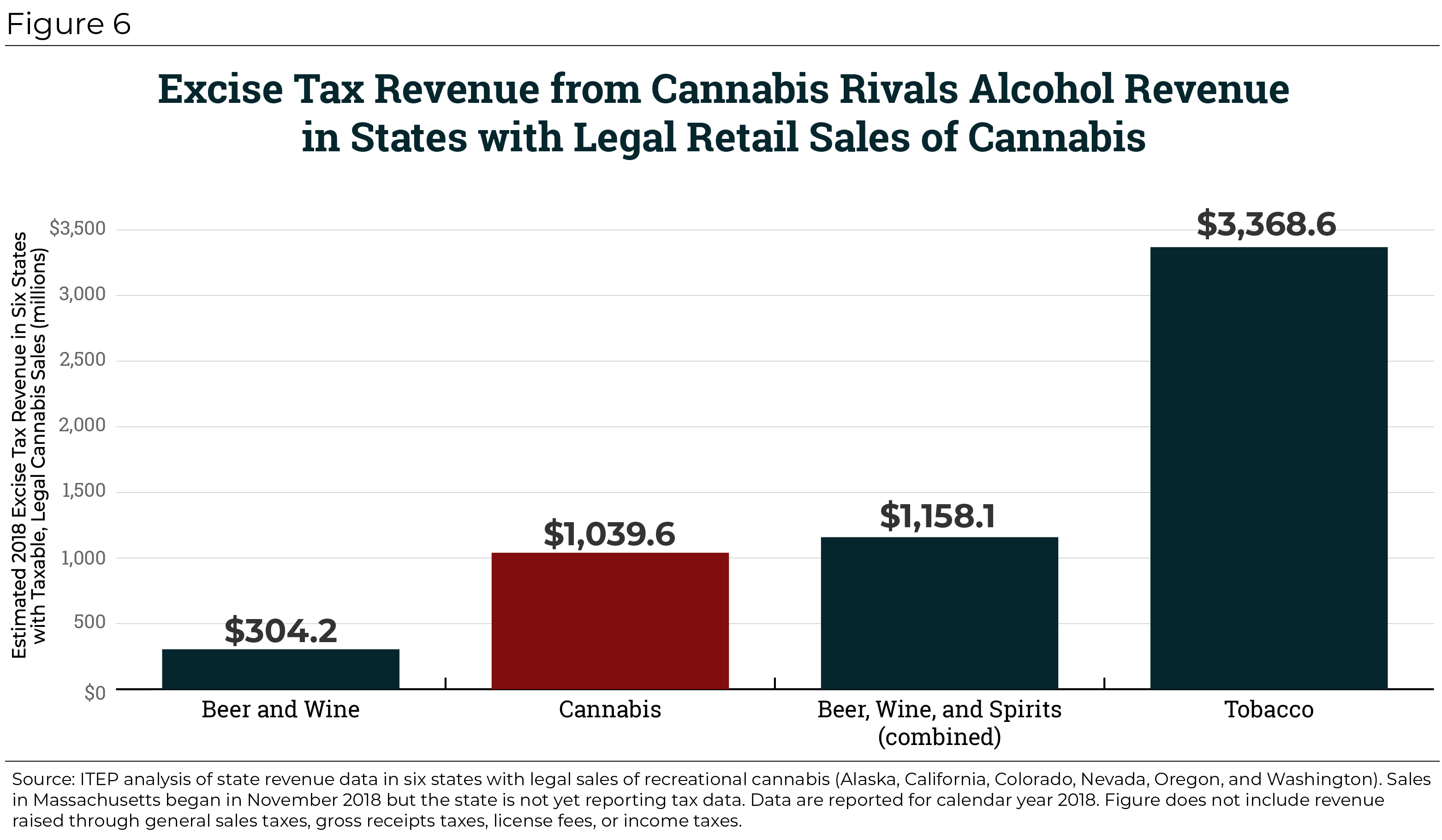

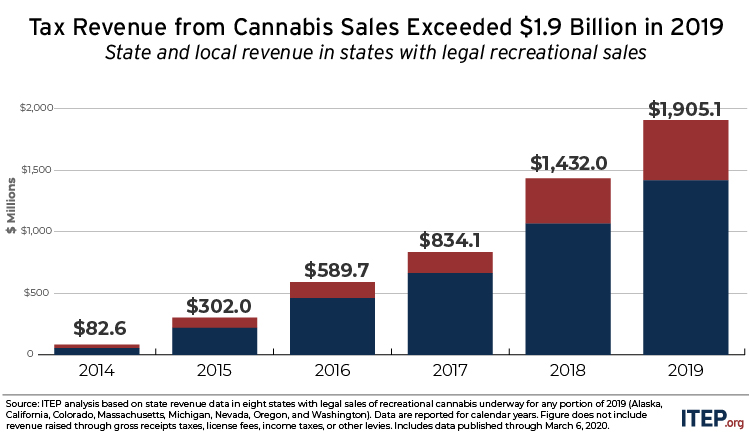

State And Local Cannabis Tax Revenue Jumps 33 Surpassing 1 9 Billion In 2019 Itep

State Alcohol Excise Tax Rates Tax Policy Center

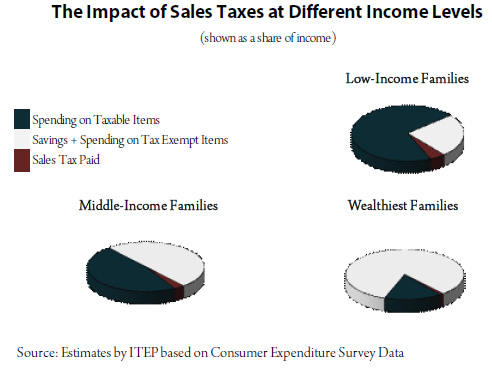

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

How Is Tax Liability Calculated Common Tax Questions Answered

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Alcohol Taxes On Beer Wine Spirits Federal State

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

How Sales And Excise Taxes Work Itep

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

State Cigarette Excise Tax Rates United States April 2015 Download Scientific Diagram

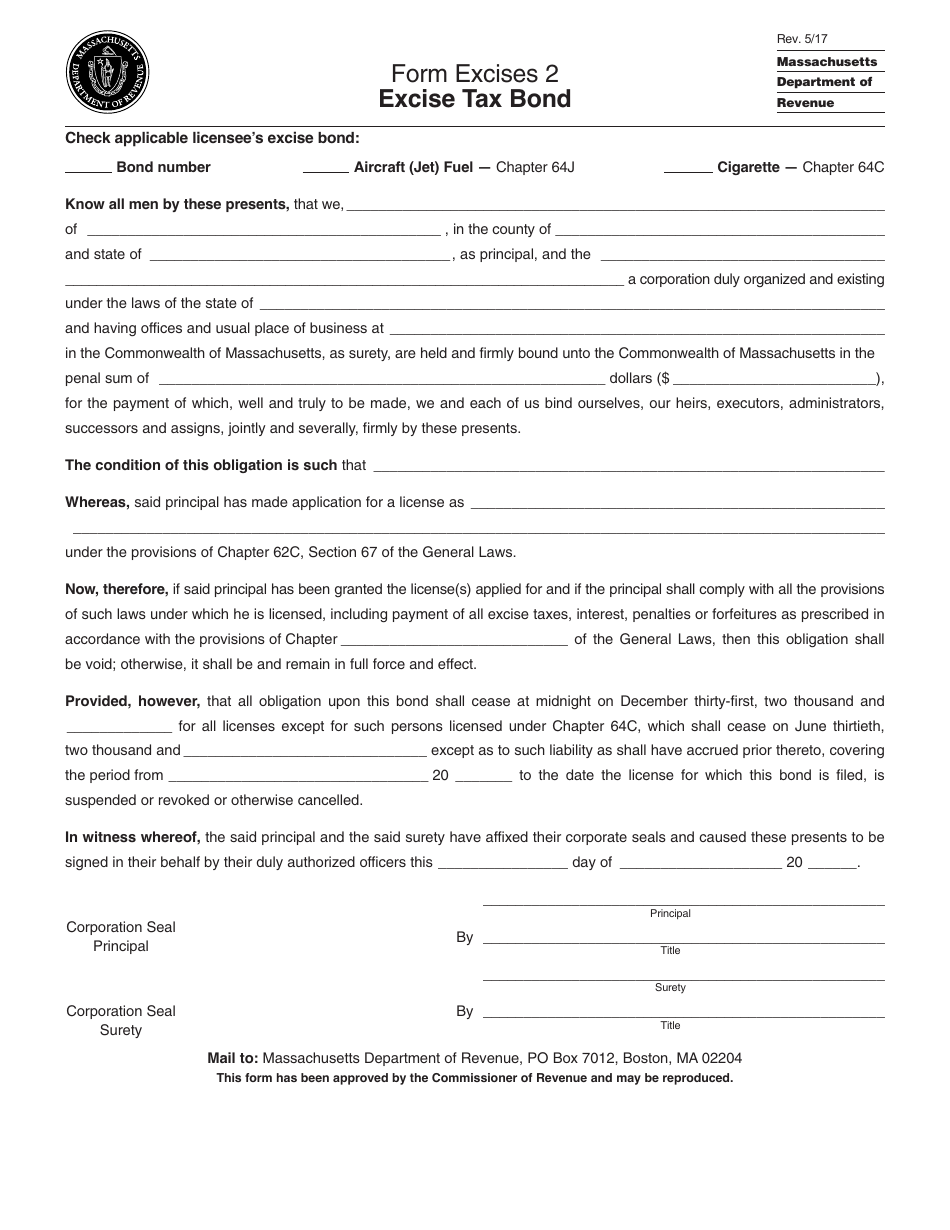

Form Excises2 Download Printable Pdf Or Fill Online Excise Tax Bond Massachusetts Templateroller